What type is the best if you'd like to buy a house: An excellent Va financing, FHA financing, or a conventional mortgage? A simple respond to may look like this:

Virtual assistant mortgage: Play with when you yourself have eligible You.S. armed forces service, generally 90 days off productive responsibility otherwise six decades on National Guard or Reserves. This type of loans generally render finest prices and you will terminology than just FHA otherwise conventional.

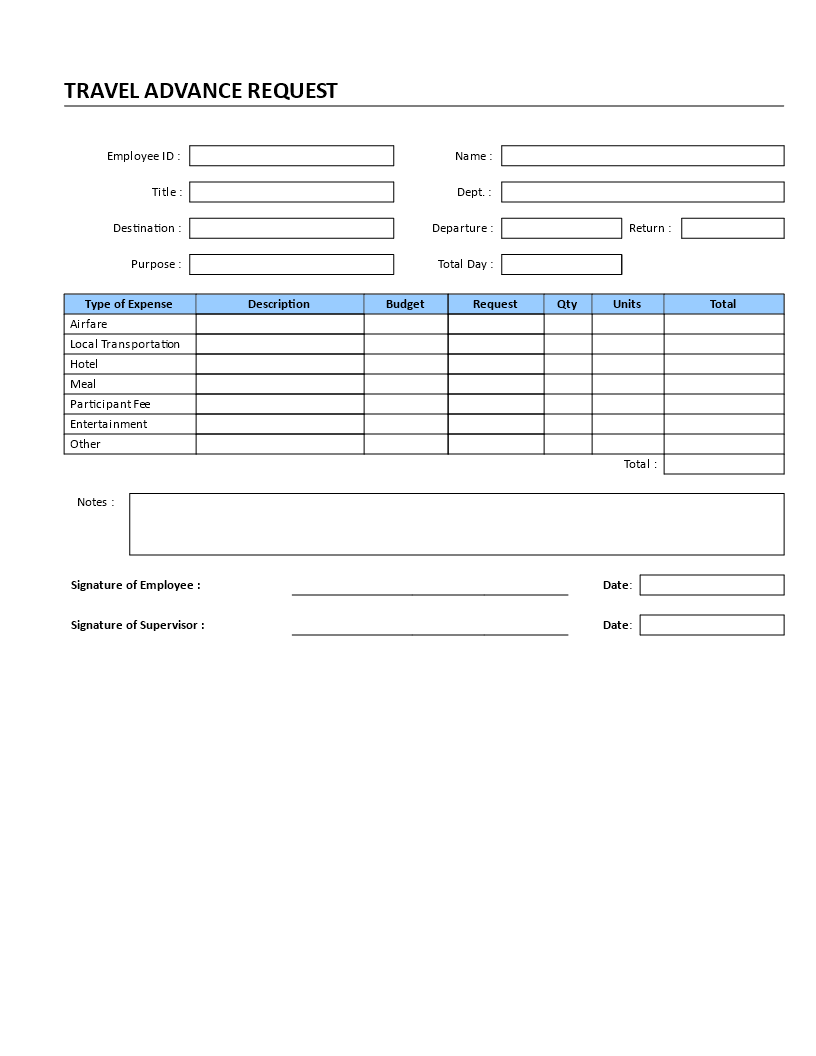

Va vs FHA against Antique Investigations

It's easy to understand why someone manage like a great Virtual assistant financing if they have qualified army provider: down rates, zero advance payment, without month-to-month home loan insurance policies.

Virtual assistant Financing: Skip This option If you have No Army Service But See Carefully If you do

When you yourself have zero armed forces services, you certainly do not need to analyze up on Va money. As they promote big words, you really need to have offered getting eligible, no exclusions.

Virtual assistant Loan Gurus

Very first, so it mortgage boasts lower prices than just FHA or conventional. Centered on Max Bluish, a home loan app business one tunes costs across tens and thousands of loan providers, rate averages toward very first quarter of 2023 are listed below:

Virtual assistant Loan Downsides

Mostly of the downsides toward Virtual assistant mortgage would be the fact it will require an initial investment payment of 2.15% of one's loan amount (high to own recite users). That's $6,450 towards the good $300,000 mortgage. Which fee is wrapped towards the financial.

The other issue with this type of financing would be the fact vendors will most likely not undertake Va also provides when you look at the aggressive avenues. New Company of Experts Facts imposes far more strict assets standards which can result in the seller and make solutions before closure.

Who Should get An enthusiastic FHA Mortgage?

FHA financing are perfect for those with a small advance payment and a middle-to-reduced credit rating of around 680 or all the way down.

Note: Having a much deeper dive to your FHA funds rather than old-fashioned financial support, pick FHA vs Antique Loan: That's Top To have Homeowners?

FHA Financing Positives

FHA fund much more forgiving with regards to all the way down credit. The us government provides loan providers up against borrower standard. Therefore, lenders approve a broader directory of borrower pages.

At the same time, FHA costs operate better for some straight down-borrowing from the bank borrowers. Old-fashioned financing regarding Federal national mortgage association and Freddie Mac computer demand risk-situated charge one translate to higher rates. Those who work in down borrowing levels spend so much more. Sometimes, so much more.

FHA was one-price matches most of the regarding pricing. Somebody which have an excellent 740 rating will pay an equivalent rates because some body that have an excellent 640 rating (though some loan providers demand their own highest prices having lower ratings).

Although not, traditional may still be your most readily useful wager when you're during the a great low income bracket, once the might be talked about less than.

FHA Mortgage Cons

Earliest, FHA funds include an upfront mortgage premium of just one.75% of loan amount. This will be equivalent to $5,250 into the an effective $three hundred,000 loan and can end up being covered with the loan. So it escalates the borrower's fee and you can financing equilibrium.

Additionally, FHA monthly home loan insurance is owed provided the new homebuyer keeps the borrowed funds. Conventional financial insurance coverage drops off if borrower is located at 20% guarantee. That have FHA, the new borrower must re-finance of FHA towards a normal financing to get rid of home loan insurance.

Just who Should get A traditional Mortgage?

When you're antique fund wanted only 3% off, individuals with huge off repayments 5-20% will get a knowledgeable prices and you may home loan insurance policies levels.

Conventional Financing Benefits

Very first, antique finance not one of them an upfront home loan insurance policies fee, protecting the fresh new debtor more than $5,000 into a great $three hundred,000 financing as compared to FHA.

Next, antique money have cancelable private home loan insurance rates (PMI). You could potentially request one financial insurance go off when https://paydayloansconnecticut.com/bethlehem-village/ you reach 20% collateral. PMI automatically falls regarding in the twenty-two% guarantee.

Remember that we said old-fashioned loans get very costly for these having down credit ratings? There can be a huge exemption.

These providers waive all exposure-founded financing fees getting basic-date consumers exactly who make only about 100% of their town average earnings otherwise 120% in the higher-pricing elements. These types of charges are called Loan Height Speed Alterations otherwise LLPAs.

By way of example, a high-money otherwise recite client having a good 650 credit rating and you may 5% off carry out typically shell out a fee equivalent to step one.875% of your own loan amount, converting so you're able to a speed on the 0.50-1% high. However the commission was waived for moderate-money first-big date customers, producing a great price write off.

Because the a buyers, cannot you will need to decide whether FHA otherwise antique often yield a better price otherwise all the way down fee. You can find too of a lot facts from the gamble. Rather, request one another rates from your lender.

Traditional Loan Downsides

Individuals with high financial obligation-to-earnings (DTI) ratios, straight down credit ratings, and you can spottier employment records ple, state some body provides a good 52% DTI, definition 52% of their gross income will go with the monthly financial obligation costs and its upcoming mortgage repayment. They probably will not qualify for a conventional financing, but can very well be eligible for FHA.

Which one do you ever like? Virtual assistant, FHA, otherwise Conventional?

Check your qualifications per mortgage variety of, up coming request monthly and you may initial will set you back towards loans to own which you qualify.