Contents

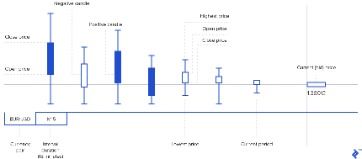

However, this was unsuccessful, and the bears lowered the price to the candle's opening price zone. The Bearish Hammer is a similar hammer reversal pattern but situated at the top. However, when it appears at the top, an uptrend ends, and a downtrend begins. The higher timeframe the hammer pattern is situated at, the more important the reversal signal is. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment.

The Hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Hanging man candlesticks are a bearish reversal pattern that forms when the market opens higher than it closes. The long wick on the candlestick indicates that there was notable selling pressure during the day, suggesting a continuous fall in the market. An inverted hammer is a candlestick pattern that looks exactly like a hammer, except it is upside down. Despite being inverted, it’s still a bullish reversal pattern – indicating the end of a downtrend and the beginning of a possible new bull move. There is also an Inverted Hammer candlestick pattern, which looks like a reversed Hammer.

The bullish hammer is a significant candlestick pattern that occurs at the bottom of the trend. A hammer consists of a small real body at the upper end of the trading range with a long lower shadow. The longer, the lower shadow, the more bullish the pattern.

This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk.

Perbedaan Hammer Candlestick dan Inverted Hammer

This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. A City Index demo comes with £10,000 virtual funds and access to our full range of markets. The only difference between them is whether you’re in a downtrend or uptrend. The Hammerand Hanging Man look exactly alike but have totally different meanings depending on past price action. Learn how to trade forex in a fun and easy-to-understand format.

In the example below, an inverted hammer candle is observed on the daily Natural Gas Futures chart and price begins to change trend afterwards. The default "Intraday" page shows patterns detected using delayed intraday data. It includes a column that indicates whether the same candle pattern is detected using weekly data.

The inverted hammer candlestick pattern is one such a signal that can help you identify new trends. A hammer candlestick is a trend reversal pattern spotted at the bottom of a downtrend. The pattern looks like a hammer, with a long lower shadow and a small body hence named as a hammer candlestick. It shows that sellers exerted considerable pressure during the session, but that buyers stepped in at the end and pushed prices upwards again. This is a very bullish sign and suggests that the downtrend may be coming to an end.

It’s how individuals, businesses, central banks and governments pay for goods and services in other economies. Whenever you buy a product in another currency, or exchange cash to go on holiday, you’re trading forex. The foreign exchange market – also known as forex or FX – is the world’s most traded market. The chart below shows the hammer pattern on the FTSE 100 index. On the one hand, you can choose to observe the market by relying on simple patterns like breakouts, trend lines, and price bars.

The complete CFD trading experience

The Hammer candlestick pattern is a powerful entry trigger. The Inverted Hammer occurs when the price has been falling suggests the possibility of a reversal. Its long upper shadow shows that buyers tried to bid the price higher. A Hammer candlestick provides a bullish signal to the price. The color of a Hammer candlestick may be either bullish or bearish. For practical purposes, I treat hammers and dojis the same way in my trading.

Right-click on the chart to open the Interactive Chart menu. Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day. Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols. For reference, we include the date and timestamp of when the list was last updated at the top right of the page.

This https://forex-trend.net/ indicates a lot of activity surrounding the asset during a particular period — the asset price dropped initially but closed near the opening price following a pullback. Similar to a hammer, the green version is more bullish given that there is a higher close. This pattern always occurs at the bottom of a downtrend, signaling an imminent trend change. On the other hand, if the price does begin to rise, rewarding your recognition of the hammer signal, you will have to decide on an optimal level to exit the trade and take your profits. On its own, the hammer signal provides little guidance as to where you should set your take-profit order. As you strategize on a potential exit point, you may want to look for other resistance levels such as nearby swing lows.

What is the inverted hammer pattern?

A protective Stop Loss should be placed below the Hammer's low or at the opening or closing price of the candle’s real body. After all, no technical analysis tool or indicator can guarantee a 100% profit in any financial market. The hammer candlestick chart patterns tend to work better when combined with other trading strategies, such as moving averages, trendlines, RSI, MACD, and Fibonacci. An inverted hammer is formed when the opening price is below the closing price.

- I began trading the markets in the early 1990s, at the age of sixteen.

- On its own, the hammer signal provides little guidance as to where you should set your take-profit order.

- It aids one in identifying the apt time to enter a market.

- Hammer candles are one of the mostpopular candlestick patternsin technical analysis.

- We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests.

An inverted hammer tells traders that buyers are putting pressure on the market. It warns that there could be a price reversal following a bearish trend. Lastly, consult your trading plan before acting on the inverted hammer.

Specifically, it indicates that sellers entered the market, pushing the price down, but were later outnumbered by buyers who drove the asset price up. Importantly, the upside price reversal must be confirmed, which means that the next candle must close above the hammer’s previous closing price. To trade when you see the inverted hammer candlestick pattern, start by looking for other signals that confirm the possible reversal. If you believe that it will occur, you can trade via CFDs or spread bets.

If the momentum is strong with a long-shadowed hammer and big confirmation candle, the price may become too high from its stop loss level, which is risky. To better understand hammer candlesticks, let’s look at how price movement creates one. I’m not sure if we are looking at the same candle, are you referring to the one with a very small upper shadow?

I had a few hundred British pounds saved up , with which I was able to open a small account with some help from my Dad. I started my trading journey by buying UK equities that I had read about in the business sections of newspapers. I was fortunate enough in my early twenties to have a friend that recommended a Technical Analysis course run by a British trader who emphasized raw chart analysis without indicators. Having this first-principles approach to charts influences how I trade to this day.

Look for a nearby area of support to place your stop at, and a resistance level that might work as a profit target. And always confirm that a trend is underway before you fully commit to your position. Both candlesticks have petite little bodies , long upper shadows, and small or absent lower shadows. 77.93% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider. A new hammer appears rejecting this resistance, giving you another short entry opportunity.

Hammer pattern is pretty indicative on 1H time frame and l if you catch early you could collect quite some PIPs in day-trade, even if it is a retracement move. It’s only AFTER the conditions of your trading setup are met, then you look for an entry trigger. Since the sellers weren’t able to close the price any lower, this is a good indication that everybody who wants to sell has already sold.

The hanging man is a https://en.forexbrokerslist.site/ pattern which appears at the top end of the trend, and one should look at selling opportunities when it appears. The high of the hanging man acts as the stop loss price for the trade. The selling indicates that the bears have made an entry, and they were actually quite successful in pushing the prices down. However, at the high point of the day, there is a selling pressure where the stock price recedes to close near the low point of the day, thus forming a shooting star.

It is actually almost the same chart, it’s just that this sequence occurred a bit later. As an example, we are opting for the first option, although it is a tad riskier. The green horizontal line signals our entry point - where the hammer closed. The red line is the low, against which we place a stop-loss around pips beneath.

After a https://topforexnews.org/, the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. This move would form a classic hammer pattern on a chart, and technical traders would then expect eurodollar to enter a new uptrend. As with any candlestick pattern, you’ll want to confirm the new trend before you open your trade.