No, you certainly do not need to-be good U.S. citizen to be eligible for a home loan. Overseas nationals normally qualify for a mortgage, so long as you can be your own property updates and you can meet new loan's eligibility requirement.

In this article:

- Could i Get a home loan As a different Federal?

- How Home Influences a mortgage

- Home loan Requirements for Low-You.S. Owners

- How to find a lending company just like the a low-U.S. Resident

Its yes you'll to obtain home financing if you're not an excellent You.S. resident. In fact, an effective 2020 learn from the Federal Relationship of Real estate professionals (NAR) showed that 62% regarding citizen international home buyers ordered their homes that have You.S.-based investment.

The process may differ based on your home reputation and other circumstances, however, decreased citizenship shouldn't present an issue when it comes so you can protecting a mortgage loan. This is how to qualify for a home loan once the a non-U.S. resident.

Can i Score a home loan As the a foreign Federal?

Files criteria whenever making an application for a mortgage loan tend to mainly depend in your resident position-be it long lasting otherwise low-long lasting. In either case, to find a property throughout the You.S. is typically a question of providing the expected immigration and visa data files and you can conference the borrowed funds conditions.

Conference qualifications conditions may be challenging for almost all international nationals which have restricted borrowing from the bank recommendations, as it may take time to determine a good record and you may credit rating about U.S. Thankfully, particular lenders do not require consumers to possess a FICO Get ? and may even choose to have fun with a good borrower's all over the world credit rating so you can evaluate the credit rating. Concurrently, loan providers are able to use non-old-fashioned solutions to gauge the creditworthiness off candidates having a thin credit score or no credit score. That will cover the lending company reviewing:

- Money for rent, tools and other recurring costs

- Checking account information, together with continual payroll places

- A career verification

- Assets suggestions

Have to Learn more about Borrowing?

For more information on credit reports and you can score, look at the Experian Borrowing from the bank Direction. So it free, interactive direction will need your as a result of all you have to see regarding your credit.

Just how House Impacts a home loan

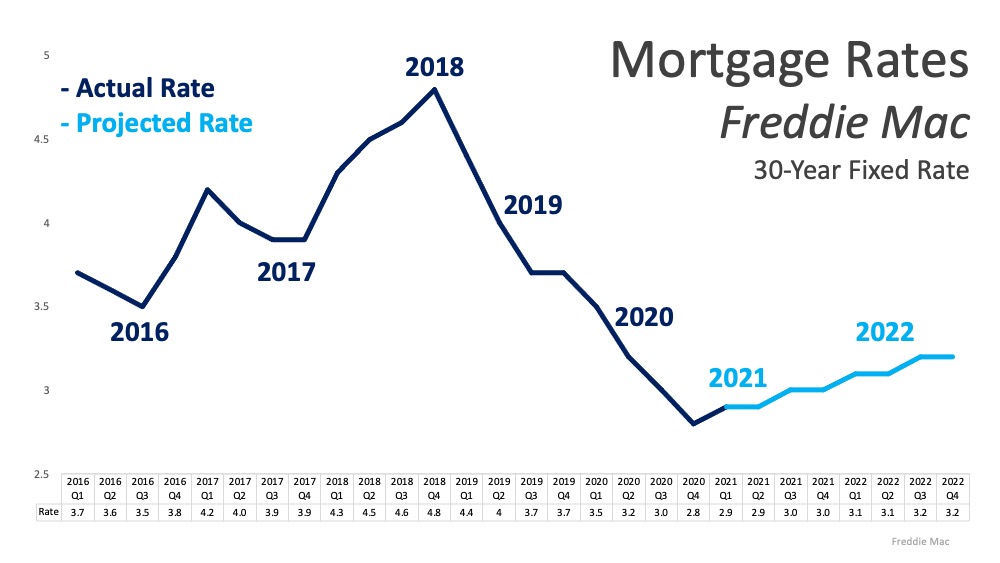

The whole process of being qualified to own a mortgage is like exactly what U.S. customers sense if you find yourself a permanent citizen that have a green credit or a non-permanent resident with a work allow or good works visa. This is because a legitimate citizen of one's You.S. is eligible getting a home loan for a passing fancy conditions given that good You.S. resident, based on criteria compiled by Fannie mae and you can Freddie Mac-the government-paid businesses one to be sure really mortgage loans while it began with the new You.S.

But not, people criteria may cause that it is much harder to possess international nationals that simply don't reside in the newest You.S. to help you qualify for a mortgage.

A loan provider can still approve a mortgage loan to possess a foreign federal whoever top home is outside of the U.S., but that implies they will not sell the loan to help you a national-backed corporation. In such a case, the lending company need a significant downpayment (as much as 29% to help you fifty%) to aid offset the risk.

Home loan Standards to possess Non-You.S. People

Non-U.S. customers need to expose legal house in the usa become entitled to Fannie mae, Freddie Mac and Government personal loans online in West Virginia Construction Administration (FHA) mortgage brokers. A debtor will get meet so it guideline whether they have the next:

- A social Safeguards matter (SSN) otherwise, rather, one Taxpayer Character Amount (ITIN).

And additionally setting-up your own courtroom residence position, additionally, you will need certainly to bring records that presents the financial institution you meet simple home loan conditions such as:

Where to find a home loan company as the a non-U.S. Resident

No matter their citizenship updates, it's always smart to examine several loan rates to ensure you get the best interest rate and you will terms readily available. You could start because of the talking with your bank, particularly if you currently bank that have an international standard bank with branches in the united states. Since they currently have monitoring of your bank account, they truly are willing to help, even although you lack a beneficial You.S.-based credit history.

You might also score estimates from an internet mortgage areas otherwise join a large financial company who can support you in finding ideal mortgage. Inform your large financial company we want to find prices to possess qualified mortgages, and this follow federal advice that shield consumers facing mortgage conditions which might be difficult to pay-off.

Before you can choose that loan, do some research to see what type of loan your is able to be eligible for, such: