Need to be noticed a dual-wide dwelling unit constructed on a long-term body and connected with a permanent basis system. This new are produced domestic as well as the property about what it is founded have to be titled as the houses. The debtor need to very own the residential property on which the fresh are created domestic is located.

Satisfy The Financial Team.

Is the most our Mortgage Downline busy or from place of work? Email address the borrowed funds Class otherwise contact us (850) 434-2211 Ext. 842 and our second offered group affiliate might be truth be told there to help you.

* To have pricing towards FHA, Virtual assistant, Investment property, and Are manufactured Home loan choice, contact all of our Home loan Category at 850-434-2211 Ext. 842

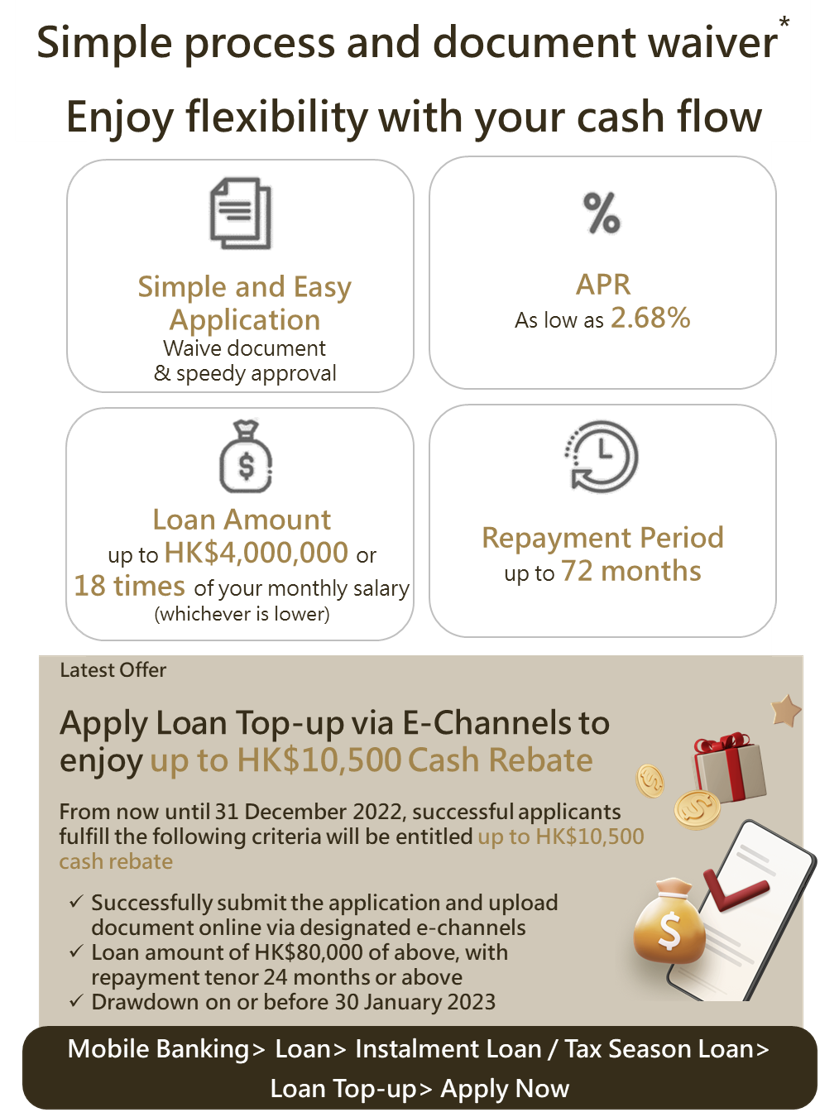

Annual percentage rate = Apr. Pricing and you may words are derived from individual credit history. Fine print pertain. NCUA Insured. Equal Casing Financial. NMLS# 405711.

For more information on funds from Participants Basic, kindly visit our Financing Cardiovascular system. Getting most recent rates, select our bad credit loan in Moosup very own Cost webpage.

* This is certainly a small date offer. Apr = Annual percentage rate. Interest based on the Wall structure Path Record primary also 0.00% to the lifetime of the mortgage that have the very least rates out-of 3.00% Annual percentage rate and you may restrict off % Apr. The credit Commitment pays all normal settlement costs except appraisal payment (if the appraisal expected) in the event that user believes so you're able to borrow $20, or maybe more at closing and believes to not pay and you will intimate the latest line of credit to have a couple of years. Whenever installing property Collateral Credit line maximum, an entire advance up to the brand new restrict have to be pulled during the closing otherwise user is accountable for brand new portion of the settlement costs on count maybe not state-of-the-art. Provide designed for the brand new loans just. Not available to the present Professionals Earliest home guarantee loans otherwise refinancing out-of Professionals Earliest home collateral finance. Contact the financing Partnership at 850-434-2211 for done facts. MFCU is an equal Construction Lender. Affiliate NCUA.

Understanding Your credit rating

** This can be a limited time render. Annual percentage rate = Annual percentage rate. Affiliate need certainly to satisfy all of the loan acceptance recommendations; the new terms and conditions mentioned above and really should agree to not ever prepay having the original 6 months. People which have got earlier zero closing prices financing paid down of the the credit Relationship must advance at least $30,000 for the the new currency in order to qualify for the newest no closure costs unique or invest in pay-all normal settlement costs towards this new financing. All fund susceptible to recognition. Regular settlement costs are paid down because of the MFCU were: Title insurance coverage and you will Recommendations, Documentary Press, Mortgage Recording Charge, and you will Ton Zone Dedication leaving out Document Thinking Commission and you may Assessment Payment. MFCU are an equal Construction Lender. User NCUA.

For further details about most of the Borrowing from the bank Union put levels, please relate to our Subscription and Membership Agreement to have Conditions and you may Conditions, Digital Transmits, Financing Accessibility, Fund Transmits and you can Information In the Deals. Delight including see our Plan off Charges.

* This is a small date give. Apr = Apr. Interest based on the Wall surface Street Record finest in addition to 0.00% with the life of the loan that have the very least rates away from 3.00% Annual percentage rate and you may restriction away from % Apr. The financing Partnership pays most of the normal settlement costs but assessment commission (if the appraisal requisite) when the affiliate believes to use $20, or maybe more at the closure and you may believes not to ever pay back and you will close the latest credit line getting 2 years. Whenever installing a property Equity Personal line of credit limitation, a full get better as much as the new limitation have to be drawn in the closing or member could well be accountable for the latest part of the closing costs with the amount not advanced. Provide readily available for the fresh funds merely. Not available toward existing People Basic household guarantee funds or refinancing from Players Very first household collateral loans. Get in touch with the financing Commitment in the 850-434-2211 to have over information. MFCU is actually an equal Casing Financial. Affiliate NCUA.