On the spring, nonbank ideal-10 loan providers loanDepot plus the investment trust The new Domestic Funding Corp. (has just renamed while the Rithm Financing) announced intends to launch HELOC points, and you will Skyrocket Mortgage and you will Protected Rates have also moved give which have family collateral affairs. At the same time, UWM joined the bedroom in the August that have standalone and you will piggyback solutions.

People can use to have a consumer loan for the 10 minutes and found finance anywhere between $cuatro,000 and you can $fifty,000 in this hours

On Springtime EQ, a house equity financial which is increasingly going toe-to-bottom with nonbank mortgage brokers in the room, interest in home equity money continues to grow once the home values and you can individuals battle financially due to inflation, said Saket Nigam, older vice-president off financial support avenues.

Household collateral facts, not, will never be a beneficial panacea in order to mortgage lenders' short-name dilemmas. “Home equity isn't going to become cure for the conventional mortgage regularity miss, but it is a way to at the very least change a few of the missing really worth to own mortgage enterprises,” said Nigam.

In the case of loanDepot, chairman and you will ceo Honest Martell advised experts the new HELOC unit are certain to get good “modest contribution” on their goal discover back into breakeven into the 2022, since “we have been launching they afterwards in the year.” All efforts arises from cutting can cost you – the lender plans to reduce 5,000 jobs.

Within Fund out-of The usa, contrary mortgages were an effective ??vibrant i'm all over this an or ugly balance piece. Overall, FoA financed $cuatro.23 million in the old-fashioned financial company on second quarter from 2022, down 17% one-fourth more than quarter and you will 39% year more than seasons. not, opposite regularity reached $1.58 million inside the Q2 2022, an excellent 7% boost versus Q1 2022 and 56% as compared to Q2 2021. The volume try a record for 5 consecutive home.

FoA might have been such as for example effective for the attempting to sell contrary, individual money and you may commercial money, products that might have high margins in comparison to the traditional home loan.

“For many who search over the years at the mortgage loans, you understand how cyclic it is. It is boom and bust. Specialization situations would be a while steadier inside their contribution in order to income. What will be volatile are traditional mortgage loans,” Patti Make, FoA's previous President, told HousingWire in advance of stepping down as the Chief executive officer in the later Summer.

The business's executives for the August told you it anticipate that family improve product, introduced inside , tend to break-even financially later come early july, getting an effective “efficient customers acquisition route at the generally no cost,” considering Graham Fleming, chairman and you may interim Ceo.

Out of FoA's second choice, Get ready said: “I might choice we could emerge that have a consumer loan inside 2022,” she said.

Swinging past financial

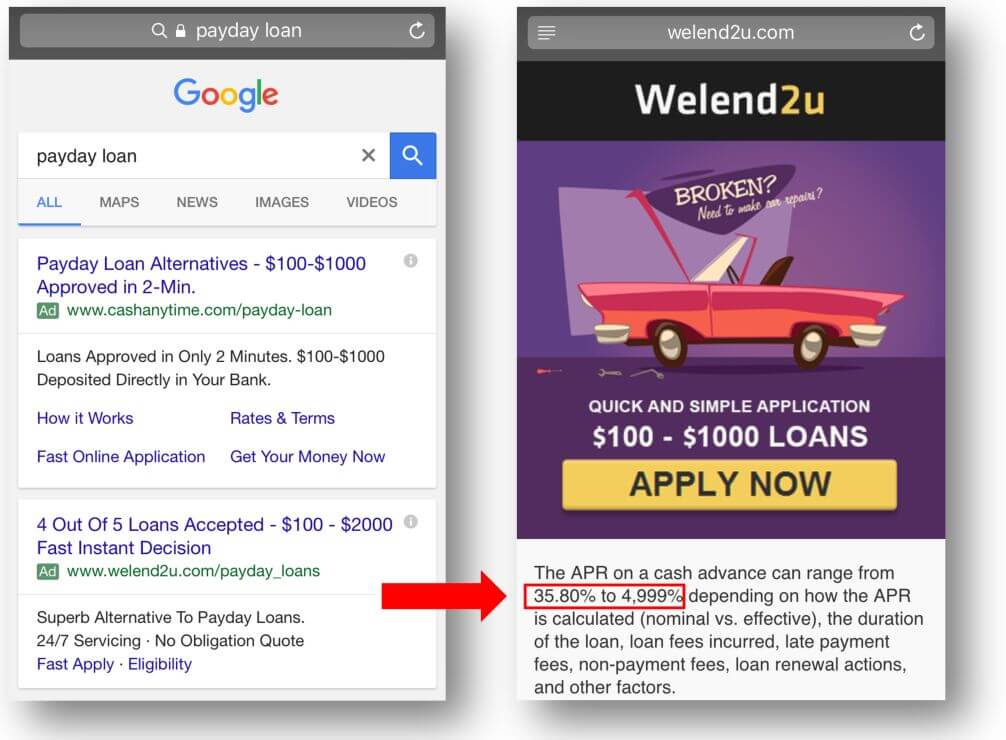

Despite the relative exposure, mortgage businesses even more opening unsecured personal loans, that have usually already been the fresh new domain name of depository loan providers, and a lot more has just, startups such as for instance SoFi.

Inside July, Chicago-based Guaranteed Rate established it got folded away the first personal loan product. Fundamental repaired rates finance are normally taken for 5.74% Annual percentage rate and % Apr.

“Unsecured loans try a rather simple way for consumers to reduce the cost of large-attract credit card debt or perhaps to let money unforeseen commands,” told you Anand Cavale, administrator vice president and you will lead from unsecured lending device at Guaranteed Rate, into the a statement.

The introduction of a personal bank loan reflects their solution to develop prevent-to-avoid digital answers to serve users all over some financial products beyond mortgages. Although unit may also be good source of home loan guides later.

Guaranteed Rate's diversified strategy appears to follow the Skyrocket Businesses roadmap. The Detroit giant also offers signed-avoid household security loans, solar power systems installment, title insurance, home brokerage, auto loans and you can handmade cards.