A national financing system offers a helping hand in order to Native People in the us seeking to purchase, re-finance otherwise rehabilitate a house, but the majority of prospective individuals aren't completely aware of the application form experts-if you don't that program exists.

Congress created the latest Section 184 Indian Financial Be certain that System so you can generate homeownership more relaxing for Indigenous Us citizens and to boost Local American communities' the means to access financial support, according to You.S. Company out of Construction and you will Metropolitan Invention (HUD). Inside 2019, 50.8% out of American Indians and you will Alaska Locals had a house, compared to the 73.3% of non-Hispanic light People in the us, with respect to the You.S. Census Bureau.

Money from Area 184 program want a reduced minimal down payment-essentially 2.25%, otherwise as little as 1.25% getting finance less than $fifty,000-and personal Mortgage Insurance (PMI) from merely 0.25%.

In comparison, Federal Casing Government (FHA) loan candidates having a beneficial FICO score regarding 580 or maybe more need the absolute minimum downpayment of step three.5%, if you're individuals with Credit ratings between 500 and you will 579 need good 10% downpayment, with regards to the latest FHA Assistance to own Borrowers. PMI is also work with from around 0.58% to one.86% of your brand-new quantity of the mortgage, centered on 2021 research in the Metropolitan Institute.

"Should you choose that math, it generates a fairly massive difference," said Karen Heston, elderly home loan banker that have BOK Economic Home loan when you look at the Oklahoma. The applying allows Native Americans to acquire a house-and you will spend seemingly little money out-of-pocket to do so, she told you.

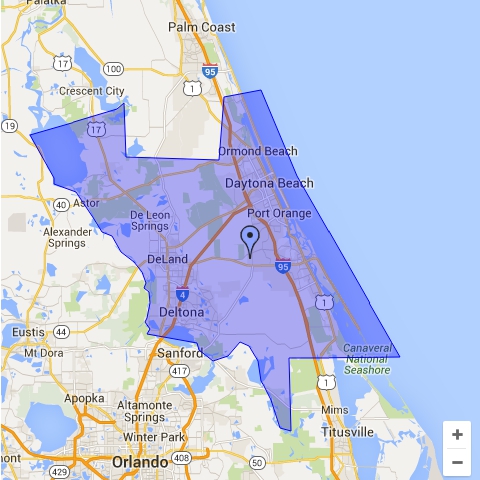

Already, Part 184 real estate loan fund try completely found in 24 claims, and Oklahoma, Arizona, Colorado, Kansas, The latest Mexico and you may Utah. In fourteen claims, as well as Tx, New york and Connecticut, the loan places Maybell new funds are merely obtainable in particular areas and you will urban centers.

A full listing of acknowledged financing areas is obtainable for the HUD site. So you're able to qualify, you need to be a western Indian otherwise Alaska Native who's a member of good federally acknowledged group.

Recommendations within the purchasing property may come from your own associations

- Concerning the Providers

- Concerning Report

- Team Reports

- Meet The Pros

- Meet the Article authors

BOK Financial Organization was a more than $50 mil local financial features business headquartered inside the Tulsa, Oklahoma with more than $105 billion into the assets around management and you will management. The company's inventory is actually publicly exchanged towards NASDAQ according to the Around the world Get a hold of markets postings (BOKF). BOK Monetary Organization's holdings tend to be BOKF, NA; BOK Financial Bonds, Inc., and BOK Financial Personal Wide range, Inc. BOKF, NA's holdings include TransFund and you will Cavanal Mountain Investment Administration, Inc. BOKF, NA operates banking departments around the 7 states just like the: Financial out of Albuquerque; Financial off Oklahoma; Bank away from Texas and you will BOK Financial (for the Washington, Arkansas, Texas, Ohio and you can Missouri); and that have limited objective offices Nebraska, Wisconsin, Connecticut and you may Tennessee. The brand new organizations stored by BOK Monetary Corporation is actually from time to time known with each other since the BOK Financial Firm Class. With the subsidiaries, BOK Financial Firm provides commercial and you may user financial, broker change, funding, faith functions, mortgage origination and you may servicing, and you can an electronic fund transfer circle. To find out more, go to bokf.

Securities, insurance policies, and you can advisory attributes considering as a consequence of BOK Financial Bonds, Inc., affiliate FINRA/SIPC and an SEC entered capital agent. Characteristics elizabeth, BOK Economic Advisers.

Investment cover exposure, along with loss of dominating. Earlier overall performance will not guarantee upcoming results. There's no guarantee that capital processes will continuously head so you're able to profitable purchasing. House allocation and you will diversification dont take away the danger of feeling capital losings. Risks appropriate to virtually any portfolio are the ones of the root ties.

Financial support And you will Insurance Products are: Not FDIC Covered | Perhaps not Secured By Lender Or Its Affiliates | Not Dumps | Maybe not Insured Because of the One Federal government Company | Will get Reduce Really worth.

Indigenous American family-possession system becomes a renew

The content on this page is actually for informative and you may instructional aim simply and does not constitute judge, taxation otherwise money information. Usually consult a qualified financial elite, accountant otherwise attorneys to possess judge, income tax and funding suggestions. Neither BOK Financial Firm nor its affiliates render legal services.