Household Security Loan Certification Standards

House security finance give residents the chance to make use of this new guarantee they've got manufactured in their residence, at some point in order to actually fool around with their resource. This type of loans promote monetary autonomy, whether or not to own home improvements, merging financial obligation, otherwise financing lifestyle occurrences. not, like all loan programs, borrowers have to satisfy certain standards to help you safer such funds.

- Adequate family equity: Not totally all collateral try tappable guarantee. Really lenders need you to preserve no less than 10-20% guarantee yourself pursuing the loan, which provides a pillow however if home prices drop-off. To put it differently, this means that you simply can't use the full number of equity collected. Alternatively, you might only use doing 80-90% from it.

- Credit history: The creditworthiness performs an enormous role into the determining the loan words and you can rate of interest. Good credit, typically as much as 680 otherwise a lot more than, demonstrates a history of in charge borrowing from the bank administration and you can prompt repayments, giving lenders way more trust on your capacity to repay the borrowed funds. Griffin Capital will accept a credit rating as little as 660, however, just remember that , a top credit rating often direct to higher cost and you will terms.

- Debt-to-income (DTI) ratio: The latest DTI proportion was a metric lenders used to look at if you can afford another type of financing. They actions your monthly financial obligation money facing the gross monthly money. Loan providers generally pick a beneficial DTI lower than 43%, because implies a far greater balance anywhere between money and debt. Although not, Griffin Financing need an excellent DTI all the way to 50%.

- Loan-to-really worth (LTV) ratio: LTV resembles the brand new security you've got of your house and that is computed by the separating extent you borrowed from in your financial of the property's appraised worthy of. Such as for instance, for folks who owe $150,000 plus house is appraised in the $200,000, new LTV are 75%. Loan providers features a favorite LTV tolerance and you will generally speaking prefer an LTV out of 80% otherwise down.

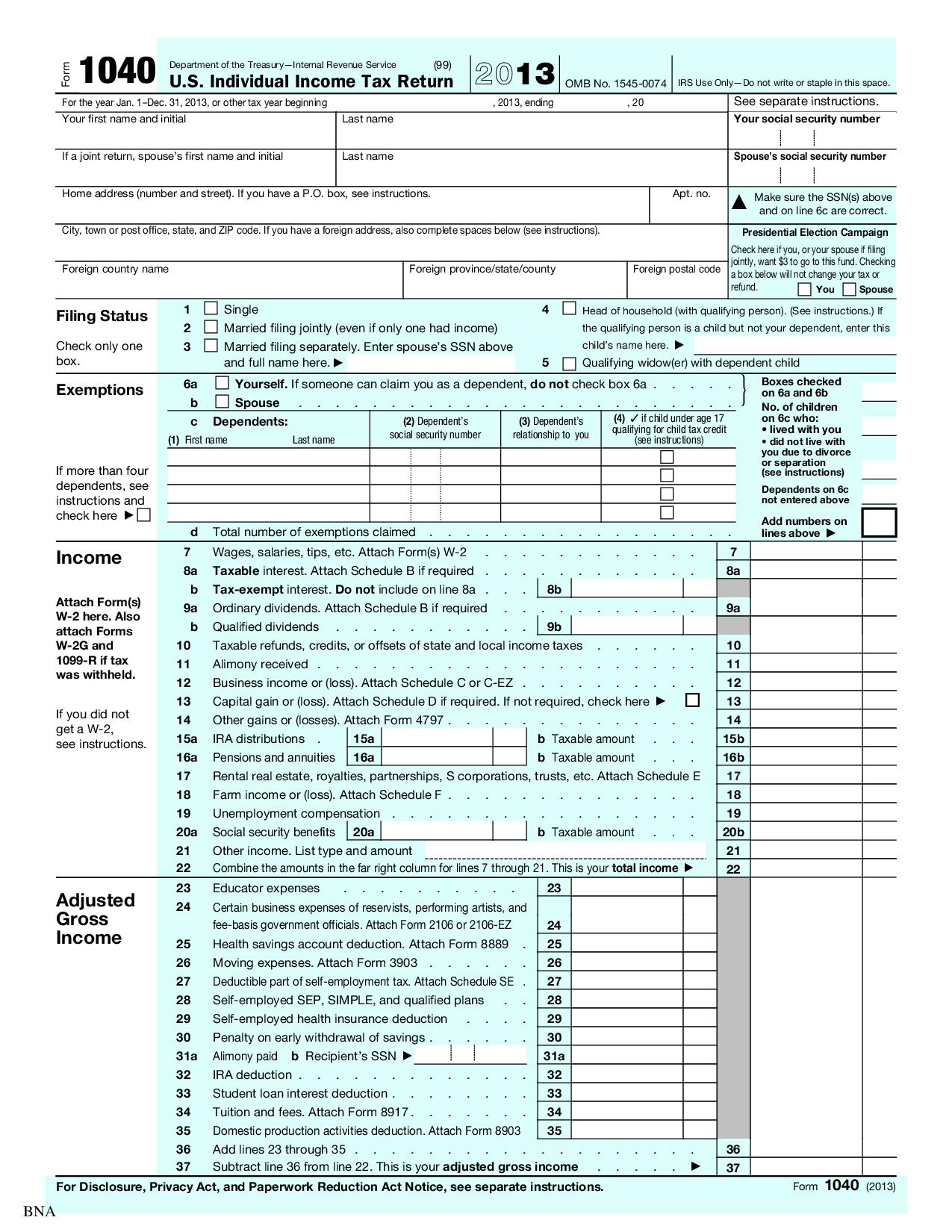

- Steady a career and you can earnings: Consistent money guarantees you could potentially meet with the month-to-month fees debt from a property security mortgage. Loan providers will generally request pay stubs, W-2s, and you will tax statements to ensure your a job reputation and income membership. Individuals who are notice-functioning otherwise has variable money might deal with way more analysis and require to add most documentation. But not, they can plus get a no doc household equity mortgage which enables them to be considered having fun with alternative papers. For example, they may fool around with a financial report family collateral mortgage that enables them to be considered using several otherwise 24 months' value of lender statements in lieu of shell out stubs otherwise W-2s.

- Assets kind of and standing: The type of property as well as condition may influence a great lender's decision. An initial house might have various other collateral criteria than the a rental property or vacation home, with regards to the bank. As well, lenders should verify its capital try sound. Property that want extreme repairs or are in elements more likely to disasters may have more strict mortgage terms and conditions or be ineligible having particular HELOANs.

Down load the Griffin Gold software now!

Domestic collateral fund will be an approach to of many financial demands, regarding high costs such knowledge to debt consolidation. Although not, as with any monetary equipment, HELOANs include their number of pros and cons.

Benefits associated with household security finance

The greatest advantage of a property collateral loan is that it allows you to influence this new security you built in the household if you are paying down their dominant equilibrium. Almost every other advantages of this type of funds include the pursuing the:

- Fixed rates of interest: Among the first advantages of household equity fund would be the fact a lot of them have repaired rates. Unlike varying interest rates which might be influenced by sector movement and can cause volatile monthly payments, fixed interest levels are still unchanged along side loan's name. This predictability could offer balances and you can openness. Understanding the right matter you'll spend https://paydayloancolorado.net/hartman/ each month can also be boost budgeting and you may economic thought, deleting the fresh new pitfalls regarding prospective rate nature hikes.