Nonetheless, financial desire is actually allowable. Just be told of great interest repaid to your bank to the a great 1098 function delivered annually inside the January otherwise early February.

Items otherwise Mortgage Origination Costs Deduction

The fees and you may circumstances you pay discover a mortgage is generally applied since a good deduction, predicated on Lisa Greene-Lewis, formal societal accountant. Circumstances may also be claimed for the Means 1098 from your bank or your own settlement report at the conclusion of the season, she says, including your rules based on how you deduct points vary to own a first buy otherwise an effective refinancing.

Property Taxation Deduction

Possessions tax deductions are offered for county and regional property taxes according to research by the worth of your home. The quantity which is deducted is the count paid because of the possessions holder, also any money produced by way of a keen escrow account within payment or closure. However, the TCJA possess set an effective $ten,000 cover with the deduction.

You might find property fees reduced on your 1098 means out-of their mortgage lender in case your possessions taxes try reduced through your mortgage company, claims Greene-Lewis. If you don't, you need to report the amount of possessions fees you purchased the season indicated at your residence tax bill.

Residential Opportunity loan places Rockville Borrowing

Property owners which strung solar energy panels, geothermal temperatures expertise, and you can wind generators in the 2020 and you can 2021 could possibly get receive a tax borrowing worthy of doing twenty-six% of pricing. From inside the , Congress enhanced that it borrowing from the bank to help you 31% to possess construction accomplished between 2022-2032. There's no maximum number which are often advertised.

Energy-successful windows and you can heat or sky-fortifying expertise could be entitled to a tax borrowing. Read the IRS's times bonus number to find out if you be considered.

Keep in mind the difference between a taxation deduction and you may a good tax borrowing, claims Greene-Lewis. "A tax deduction reduces your nonexempt earnings, but your actual taxation reduction is based on their taxation group. A taxation borrowing was a buck-for-buck lack of brand new taxes you owe."

That means borrowing from the bank helps you to save way more. A taxation credit from $100 would lower your income tax responsibility because of the $100, while you are a taxation deduction of $100 perform reduce your taxes from the $twenty-five if you are on the 25% tax class, says Greene-Lewis.

Frequently asked questions

The most effective taxation crack getting homebuyers is the financial interest deduction limitation as much as $750,000. The high quality deduction for individuals is $a dozen,950 in 2022 and also for maried people submitting as one its $25,900 (rising so you're able to $thirteen,850 and $27,700, correspondingly, when you look at the 2023). There are more taxation getaways that a person can allege oriented towards specifics of the house are purchased additionally the individual.

What are the Very first-Date Homebuyer Software?

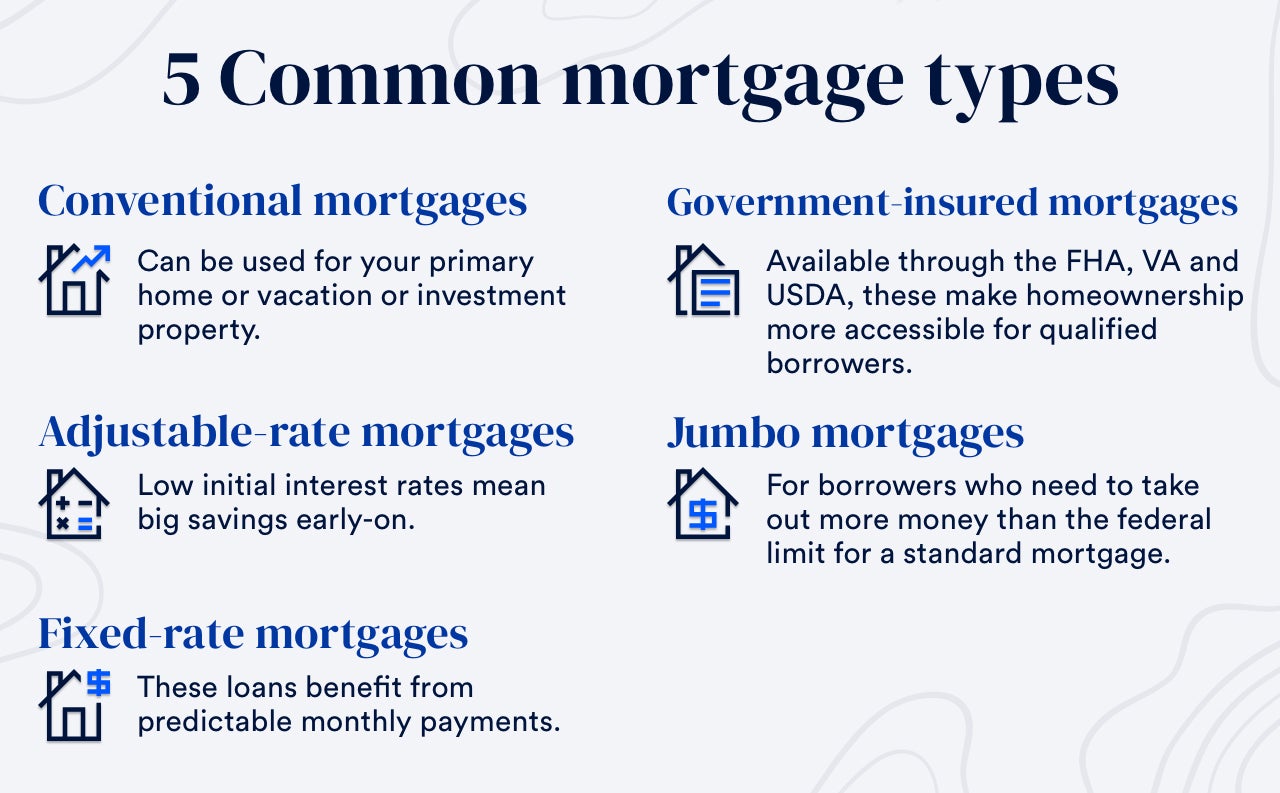

Probably the most preferred earliest-date homebuyer programs is FHA financing, USDA finance, Virtual assistant loans, Fannie mae or Freddie Mac programs, the brand new Indigenous American Direct Mortgage, and energy-Productive Mortgage loans.

What is the First-Big date Homebuyer Operate?

The initial-Time Homebuyer Work is an expenses advised not as much as Chairman Joe Biden to minimize an individual's tax bill of the $fifteen,000 getting single people and you can $eight,five-hundred to have hitched some body submitting individually. The balance remains waiting to feel accepted are generated to your legislation.

The bottom line

Homeownership costs extend past down money and you may month-to-month home loan repayments. Be sure to consider just how much home you'll be able to afford prior to starting in order to have a look-not simply towards household, however for a lending company.

Be sure to reason behind closing costs, moving can cost you, your house examination, escrow costs, home insurance, property taxation, will set you back out-of solutions and you may restoration, it is possible to homeowner's association fees, and," claims J.D. Crowe, chairman out of The southern part of Home loan in addition to previous president of your own Mortgage Lenders Organization off Georgia.